Strategic Healthcare Mergers and Acquisitions (M&A)

Ophthalmic Surgery Market Trends

09/16/2013

As part of our Healthcare M&A and strategic consulting services, we offer the following overview of the ophthalmic surgery market as a context to understand mergers and acquisitions in the sector.

- Continuing market growth

Diagnostic and treatment volumes are expected to increase as the population ages. The number of Medicare patients is expected to double in number of the next two decades. Surgical volumes for ophthalmology are expected to increase 30-50% over those years. - Minimally invasive techniques continue to expand

Tempered by technology and surgeons' ability and willingness to adapt to new methods, micro-incision cataract surgery with ultrasound equipment, instrumentation and foldable IOLs is enabling surgeons to extract the cataract and implant the IOL through an incision as small as 1.8mm. - Femtosecond lasers will continue to make inroads

within refractory surgery, cataract surgery, cornea surgery and other areas. It allows the surgeon to focus the laser energy at a particular depth and then rapidly cut the tissue at that depth without causing any additional injury to the surrounding tissue. It has the potential to replace some of the technically demanding manual steps in cataract on other surgeries and may foster faster healing times. Femtosecond lasers are now used for keratoplasy, to generate precise LASIK flaps and accurate keratotomy in refractive corneal surgery and to create the capsulorrhexis, corneal relaxing incisions, nuclear fragmentation, and the primary and secondary incisions in refractive cataract surgery. - Abbot's recent purchase of OptiMedica for $250m plus $150m in contingent milestone payments demonstrates the importance of this Femtosecond lasers as well as Optical Coherence Tomography (OCT). See table below.

- An issue with femtosecond lasers has been cost, but a recent survey of 134 U.S. centers with femtosecond lasers installed by the end of 2012 found that 20% of cataract surgical procedures with a conventional IOL and 74% of procedures with a presbyopic IOL were performed with a femtosecond laser. Conventional IOL patients were charged an average of $1,058 more for a femtosecond laser. Conventional IOL patients were charged an average of $664 more and presbyopic IOL patients were charged $673 more. Taking into account the $438,200 cost of the laser equipment and the $165,200 service cost for years 2 to 5 resulted in a need to perform 1,134 laser cases in the first 5 years to break even, or 19 cases per month.

- OCT (Optical Coherence Tomography) is gaining acceptance as a key diagnosis modality

OCT, measuring the echoed time delays of a reflected light beam, produces a higher imaging speed, higher pixel densities and better image quality, with a consequent improvement in diagnosis. The allure of the Abbot/OptiMedica deal was OptiMedica's Catalys system, which includes an image-guidance, OCT and laser system. - Glaucoma procedures

New Glaucoma procedures offer substantial safety and efficacy improvements over older surgical technologies to treat glaucoma during Phaco catact surgery and refractory glaucoma. They include Endo Optik's minimally invasive endoscopic/low-power laser approach and Glaukos' iStent (implanting a stent in the eye). - Retinal procedures

While cataract surgery remains the most popular ophthalmic procedure, retinal procedures, such as pars plana vitrectomy are likely to become more frequent. Shorter procedure times and less-invasive techniques have made retinal procedures more attractive. The global market for vitreoretinal surgery devices is forecast to reach about $600m in 2016 with a CAGR of 4%. Globally, about 350,000 vitreoretinal surgeries are performed each year. Technological advances have been a key growth driver -- the advent of 23-gauge microincision vitrectomy instrumentation has allowed surgeons to reduce the size of scleral incisions to a fraction of what was possible with standard vitrectomy. - Use of Multi-focal, Accomodating and Toric IOL implants will grow

Although the price of lens implants are bundles into payments for cataract surgery, if a physician and patient select a higher-end multi-focal implant, such as Alcon's ReStor IOL or Abbott's ReZoom IOL, ASCs, can balance bill a patient for the additional cost of the lens.

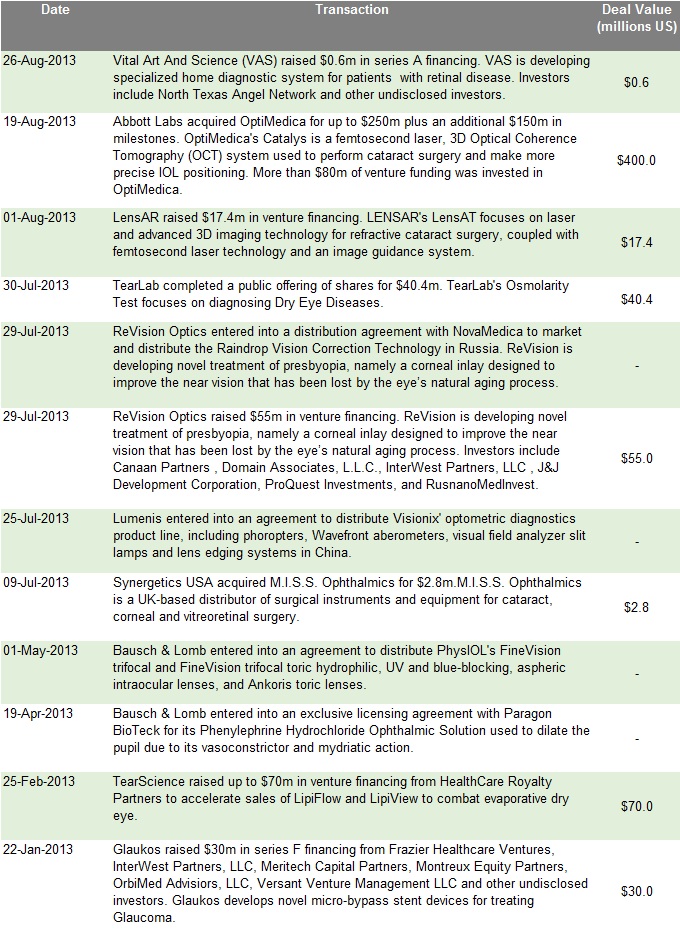

Recent healthcare M&A, financing and strategic relationship activity reflect the foregoing trends: