Strategic Healthcare Mergers and Acquisitions (M&A)

Aesthetic Market Dynamics 2013

10/02/2013

The Walden Group's assessment of aesthetic market dynamics:

- Large and Growing Market

Since 2000, U.S. aesthetic procedures have grown from 5.7 million to 11.5 million (CAGR 12%), representing a total market opportunity of $12.2b (source: Global Data). Americans spent almost $11 billion on cosmetic procedures in 2012 of which $6.7 billion was spent on surgical procedures; $2 billion on injectables; $1.8 billion on skin rejuvenation procedures; and over $483 million on other nonsurgical procedures, including laser hair removal and laser treatment of leg veins. - Economic Challenges

The aesthetics industry largely depends on consumer’s discretionary spending levels which were pounded by the great recession. After the recession, the global facial aesthetics market rebounded with 15% growth in 2011. Even with the cash/non-reimbursement nature of aesthetic treatments, there is an inexorable attraction to looking younger, which drives growth. Yet, being a decentralized market, there are areas where the demand for aesthetic treatments remains soft. - Industry Consolidation

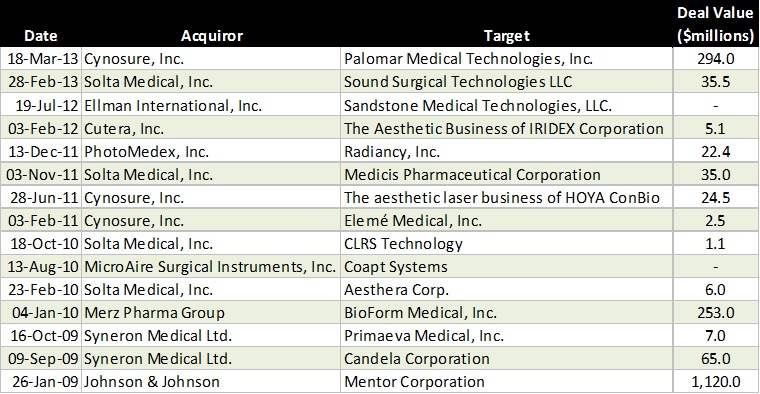

Low valuations combined with strong competition is likely to result in consolidation, as is evidenced by recent deals including J & J’s acquisition of Mentor, Merz Pharma Group’s acquisition of Bioform Medical and Cynoclosure’s acquisition of Palomar Medical Technologies. See table below. - Increase in Aesthetic Providers

As the economy improves, primary care physicians will dive deeper into the aesthetics sphere. The trend of physicians journeying into aesthetics began in 2004 and resulted in the rapid emergence of medical spas. This trend slowed down in early 2009, but economic recovery has re-fueled the dynamic. - Breast Implants & Reconstruction

Traditional silicone gel breast implants involve the risk of an undetectable rupture only seen with an MRI. Saline implant offers the tissue-like feel of a silicone gel implant and are filled by a physician (not the manufacturer) to allow for more precise sizing. Saline is said not to involve the wrinkling, bouncing and globular look of silicone implants, but many women prefer silicone.

For women undergoing mastectomy for breast cancer, implant breast reconstruction is increasingly common. Over the past 5 years, new trends involving the use of ‘next-generation silicone’ and saline-filled implants, acellular dermal matrices and fat grafting have expanded reconstruction treatment options.

Tissue expanders remain the most common first step in breast reconstruction with implants. Advantages of tissue expander-based breast reconstruction include relatively short surgeries, relatively short hospitalization, recovery times of 2 to 4 weeks, and absence of further surgery on other parts of the body. Tissue expander reconstruction is accompanied by a second surgery to exchange the tissue expander for the permanent implant. Radiation may prevent a patient from safely having a breast implant reconstruction or increase the risk of a wound healing problem or infection in some cases.

Surgeons in the U.K. and Australia are also actively testing the theory that stem cell enriched fat improves the survival rate of tissue in a fat transfer which may have positive implications for rebuilding the breast after a mastectomy. - Dermal Fillers

Used for anti-aging to treat wrinkles and curves in the face, dermal filler procedures, or “liquid facelifts,” take very little time. Dermal fillers include botulinum toxin (Botox), Hyaluronic Acid (HA) fillers, particle and polymer fillers (PPF) and collagen products. A shortcoming of dermal fillers and injectables is their temporary effects, leading patients to undergo multiple treatments. HA fillers are not permanent as collagen disintegrates due to aging. Results typically last 12 months and procedures cost about $500-$1000. Botox treatments last six months and cost up to $500. - Alterative Procedure Options

Newer, less invasive, less expensive procedures have gained favor compared to surgery. New non-surgical options include ultrasound and laser therapy for facelifts and the use of radiofrequency to shrink fat cells. = - Obesity, Lap-Band and Loose Skin

More people will undergo Lap-Band surgery to lose weight as the FDA dropped the Body Mass Index limit to 30 for obese individuals with health problems. An after-effect of such weight loss surgeries is the abundance of loose skin. As the number lap band surgeries increase, the demand for skin tightening will continue to grow.

Recent Healthcare M&A activity in the Aesthetic and Plastic Surgery Market: